41 HQ Photos Best Apps For Small Business 15 Must Have Apps For Small Business Management

Here are some of the best digital-only business bank accounts available in Canada: 1. Vault: Overall best business bank account for SMBs. Vault is Canada's newest all-in-one business banking.

Paypal Canada Business Account Opening YouTube

Fees. Fees for basic chequing accounts can range from $0 to $25 per month. You can pay upwards of $125 per month for an unlimited plan with some banks. Transactions. Basic small business banking accounts typically offer between 5 and 25 free transactions and deposits per month.

Best Business Account Management CRM Software for 2022 ROI Advisers

The best business bank accounts in Canada include payroll solutions to help you pay your staff and suppliers. This makes it easy to set up automatic payments by direct deposit. Easier to keep tax records. Keeping your business finances separate from your personal expenses will make things a lot easier come tax time. With all your business.

Top 9 Business Bank Accounts With No Credit Check In 2022

19. CIBC Business Savings Account. The CIBC Business Savings Account is another great option for small businesses that are looking to grow their savings. This account offers a competitive interest rate of 0.40% to 0.65% based on the daily closing balance, with no monthly fees.

The Best Business Account For You

TD Every Day Business Plan A. Monthly fee - $19, waived with a minimum balance of $20,000. Additional fees - $1.25 for each additional transaction, $.22 for additional deposits, $2.50 per additional $1,000 deposited. Monthly transactions - 50, $5,000 for cash deposits.

How To Manage Your Money As a Software Developer Freelancer Best Business Account for

Additional Deposit Item Fee: $0.25. The Scotiabank Right Size Account for small businesses is a basic business account that includes four monthly transactions. Beyond that, the cost per transaction is tiered, as follows ($1.25 for 1-15 transactions, $1.15 for 16-50, and $1.00 for 51+).

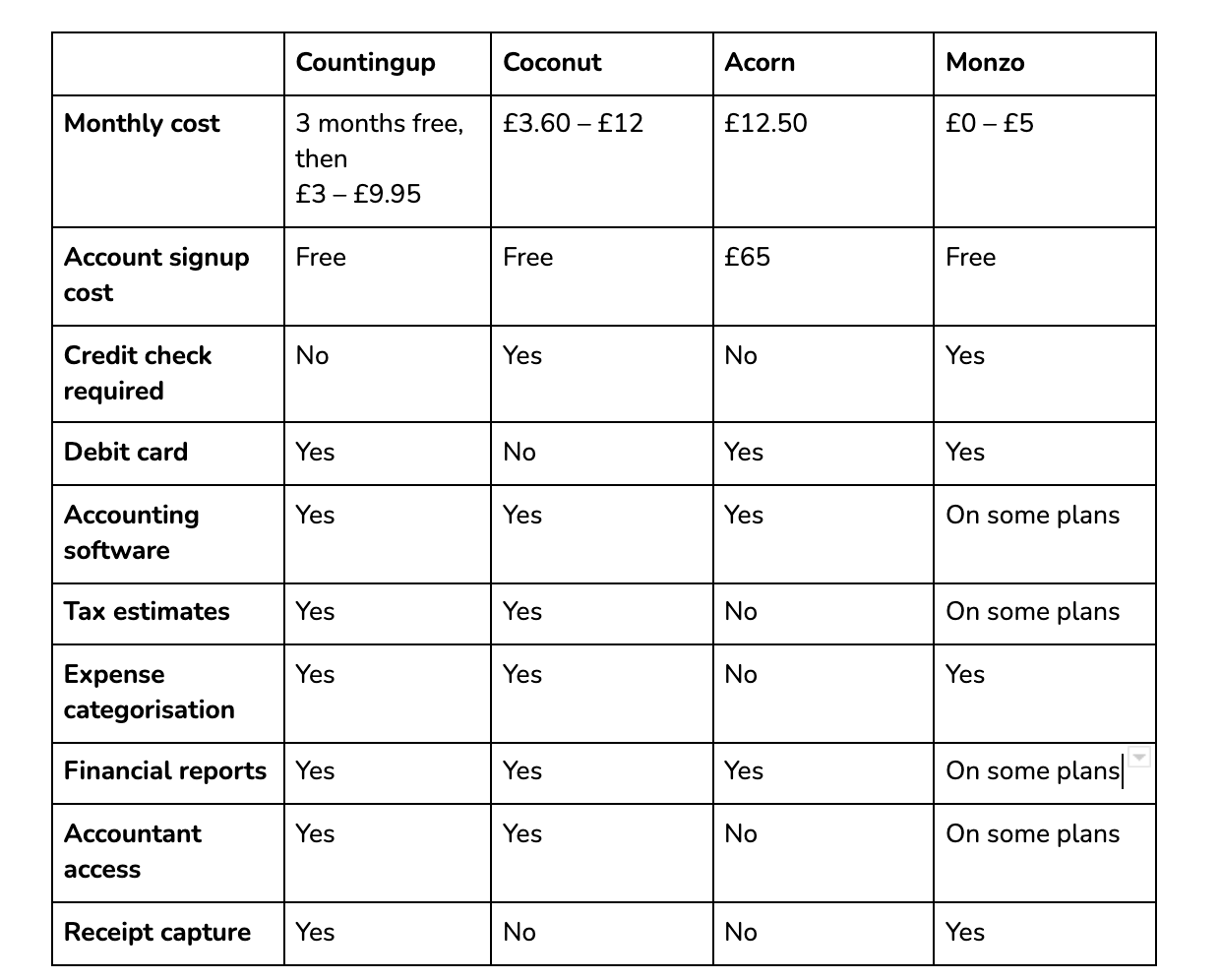

The best business account for your business Countingup

Wise. Wise is a hassle-free money services business. The Wise business account can be used by businesses of all sizes.¹. You can pay employees, get paid and manage your cash flow overseas all in one place. You can also manage your money without dealing with high exchange rates, hidden charges and monthly fees.

Canada Emergency Business Account 40,000 Investment Guide

TD Basic Business Plan. Monthly Fee: $5. Includes: 5 transactions/month. TD's Basic Business Plan is a solid option for a side hustle business if you already bank with TD. You get 5 free transactions per month, and then you'll pay $1.25 per transaction after that and $2.50 per $1.000 in cash deposits.

How to open a Business Account in Canada?

Overall Best Small Business Account in Canada 1. Loop Corporate Banking. Loop is a Toronto-based financial technology platform specifically built for growing businesses and entrepreneurs who want to explore global markets.. It offers multiple global business banking accounts in one platform, providing Canadian businesses access to US, EU, and UK accounts in just a few clicks.

Alternative to opening a business bank account in Canada Payoneer Blog

The best business bank account in Canada is determined by your business needs, such as the number of transactions and deposits you make per month. The big 5 banks all offer chequing and savings accounts for business owners. You'll typically have several options, starting with a basic, low-fee account with limited transactions to a full.

TransferWise Business Account, Canada [2022 Review] International MultiCurrency Bank Account

Note: All interest rates are accurate as of February 6, 2024.Please check bank sites directly for the most up-to-date information. RBC Business Essentials Savings Account. The RBC business savings account is a flexible account worth looking at, offering clients up to 999 credit transactions, 2 free cheque or debit transactions per month, and the ability to transfer funds in and out of your.

Best Business Bank Accounts for LLCs InDepth Guide [2023]

Best Business Bank Accounts in Canada. Tangerine — Earn 1.60% to 4.65% APY on your business cash savings. Wise Business — Send transfers internationally at the market rate. Payoneer — Integrate with e-commerce stores around the world. Alterna — Digital account for low-cost day-to-day transactions.

Best business account for freelancers in Ireland Advice for the selfemployed

A budget-friendly plan for everyday business banking. $19.00 monthly fee ( $0 with fee rebate when you hold a minimum daily balance of $20,000) 50 deposit items. 20 transactions. View Details. Book appointment.

Wise Business Account in Canada Our Review for 2023

To determine this best list, Finder Canada analyzed 18 business bank accounts across 14 financial institutions. We compared accounts from traditional banks, digital banks, fintechs and credit unions. We narrowed down the list of accounts to the top 4 by only listing accounts that are available in all Canadian provinces.

Canada What to Know When Opening Your First Bank Account Personal Finance Guide

In our guide to the best business bank accounts in Canada, we break down the top business accounts for a wide range of businesses, including: Basic chequing accounts. Business bank accounts that support unlimited transactions. Free business bank accounts. Multi-currency business accounts.

Canada Emergency Business Account Update for NonBusiness Banking Account Holders Ontario

However, the fees are generally lower, which makes them a great place for new business owners to start. With that in mind, here are some of the best low-volume small business bank accounts in Canada. 5. RBC Digital Choice Business Account. Monthly Fees: $6 per month 1.

.